non ad valorem tax florida

If you do not receive a tax bill in November you may print one from our. Non-ad valorem fees can become a lien against a property whether homesteaded or not.

There are different types of non-ad valorem assessments that can appear on your TRIM Notice.

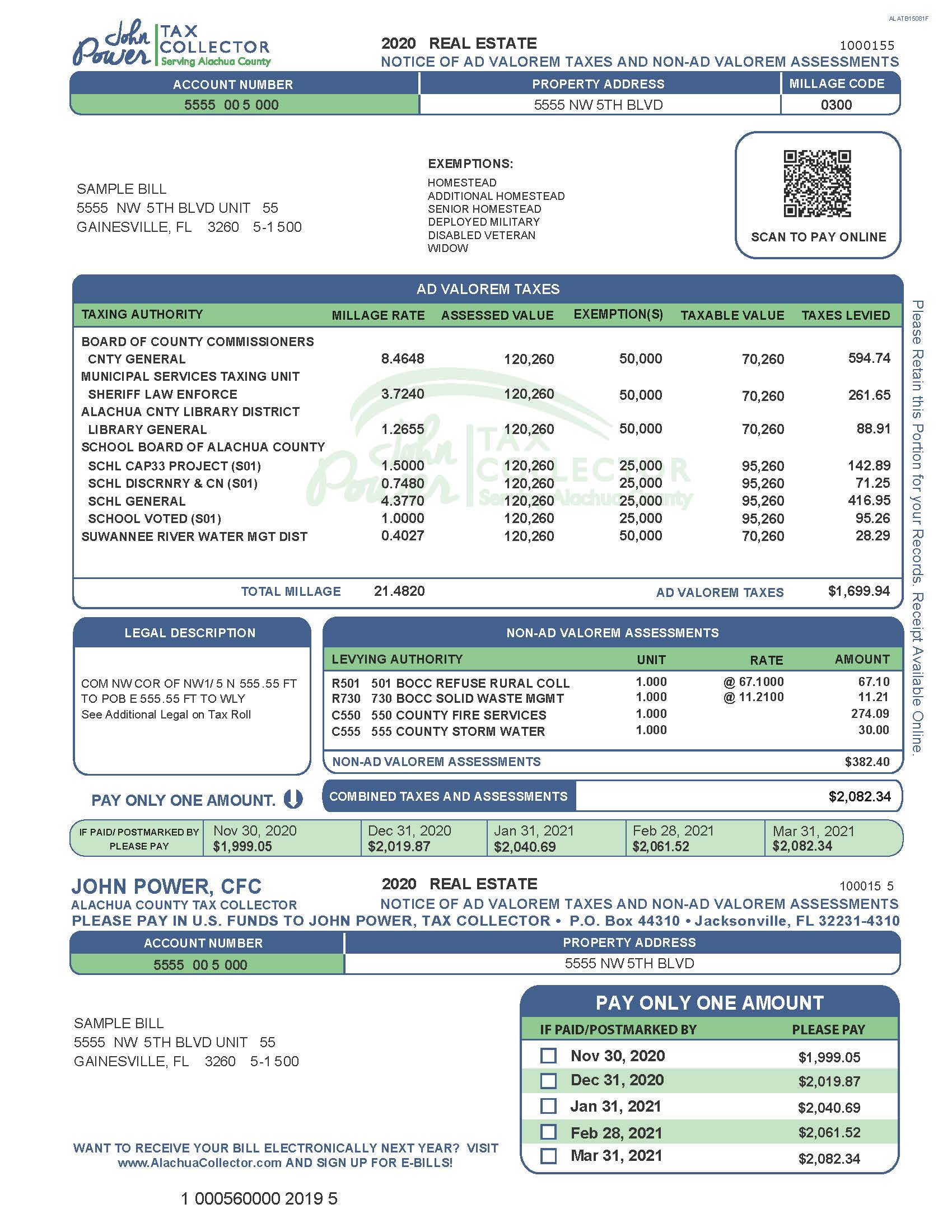

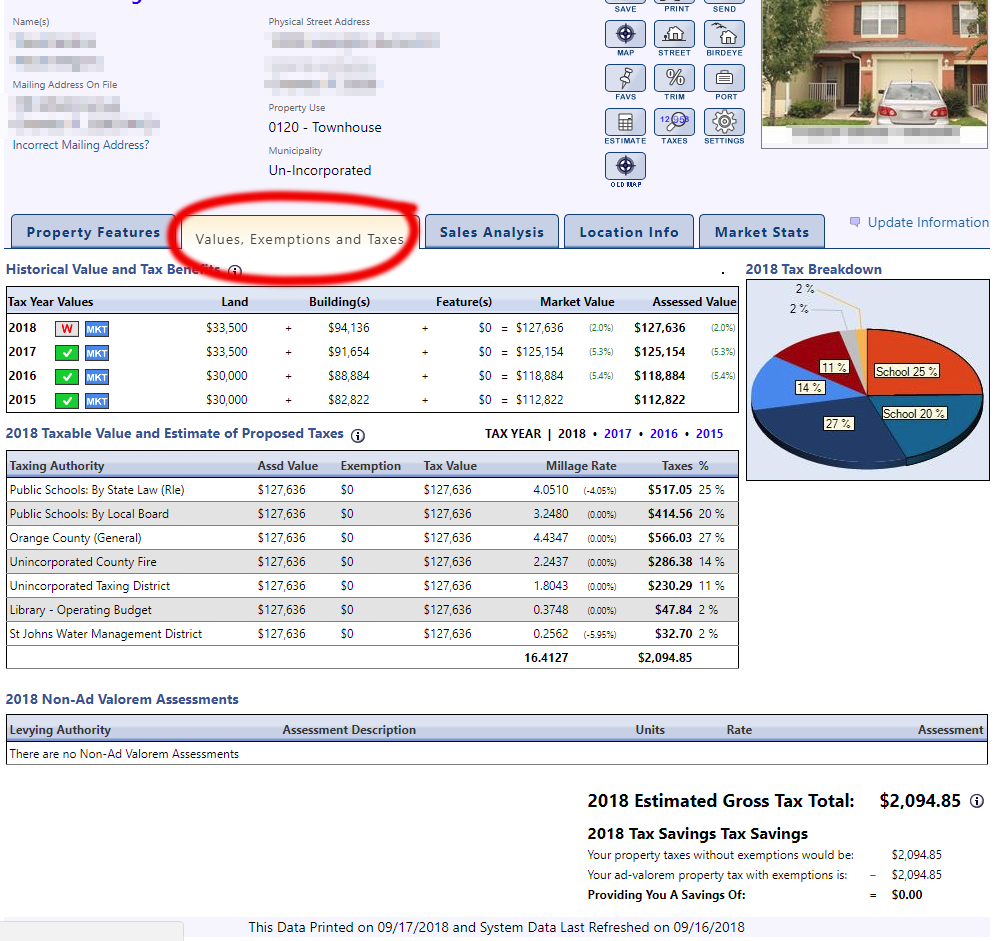

. The real estate property tax notice also includes non-ad valorem assessments levied against the property for services such as solid waste fire rescue libraries and other special assessments. It includes land building fixtures and improvements to the land. Ad-valorem taxes are based on.

A non-ad valorem assessment approved by BoCC to fund street light operation in subdivisions outside municipalities. Applicants who timely file by March 1 possess title to the real property and are bona fide Florida residents living in the dwelling and making it their permanent home as of January 1 qualify for the exemption. County and municipal governments as well as local taxing authorities such as the School Board and South Florida Water Management District Childrens Trust determine tax rates also.

Polk County Lighting District. Some non-ad valorem assessments are paid in advance. These amounts are set by the applicable taxing authorities in the county.

They may be calendar year or. As a property owner in Indian River County it pays to be informed about your rights and responsibilities under Florida law. Non-ad Valorem assessments are based on factors other than the property value such as square footage or number of units.

To view the annual millage rates and assessment provided to the Tax Collectors Office please. Levying authorities such as stormwater utilities fire and rescue and solid waste are responsible for setting the non-ad valorem assessments. The real estate tax bill is a combined notice of ad-valorem taxes and non ad-valorem assessments.

Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies. The statutory deadline for filing a timely exemption application is March 1. All Roadway Improvement Assessments MSBUs.

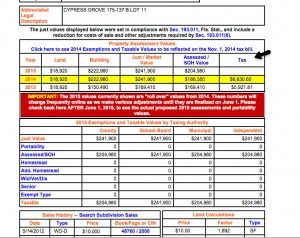

The tax rolls contain the Name and Mailing Address of the property owner the parcel identification number the legal description the assessed value and exemptions for the property and the amount of taxes due. Office Locations KTA Orders Career English. Ad Valorem is a Latin phrase meaning According to the worth.

Taxing authorities set the Millage Rate that is factored with the. Non-ad valorem means special assessments and service charges not based upon the value of the property and millage. Applicants who fail to apply timely may still file an application on or before the 25th day following the.

Ocala Florida 34471 Phone. Real property is located in described geographic areas designated as parcels. Florida property taxes are relatively unique because.

In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property. Office of the Marion County Tax Collector PO BOX 63 Ocala Florida 34478-0063. The Tax Collector also collects non-ad valorem assessments which are also made by taxing authorities on real property to provide essential services such as fire protection garbage collection lighting etc.

Proudly serving the citizens of Indian River County and the State of Florida. Using the ad valorem values and allowing for exemptions. CUSTODIAN OF PUBLIC RECORDS.

English Spanish Chinese Portuguese. Polk County School Board PCSB The following ad. All owners of property shall be held to know that taxes are due and payable annually before April 1 st and are charged with the duty of ascertaining the amount of current and.

UNDERSTANDING YOUR TAX BILL. Still cant find the answer. Florida law provides for a number of ad valorem property tax exemptions which will reduce the taxable value of a property.

Non-Ad Valorem Taxes Non-ad valorem assessments are based on the improvement or service cost for a property example. Non-ad valorem assessment units approved by BoCC to fund roadway improvements etc. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

These records are used to create the tax bills that are mailed out by November 1st each year. Taxes on each parcel of real property have to be paid in full and at one time except for the installment method and homestead tax deferrals. Solid waste and fire rescue and are levied on a benefit unit basis rather than on value.

Ad Valorem taxes are collected on an annual basis beginning November 1st and are based on that calendar year from January 1st through December 31st. When purchasing a property with a non-ad valorem be aware that the. Tax notices are mailed to the owners address as it appears on the certified tax roll normally on or before November 1st.

Understanding the procedures regarding property taxes can save you money and will help this office to better serve you. The most common real property exemption is the homestead exemption. Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December.

They are levied annually. Need Non-Ad Valorem andor Ad Valorem contact information. The Tax Collector collects all ad valorem taxes levied in Polk County.

Make an Appointment Make an Appointment Services Property Tax Real Estate Homestead Deferral Plan Delinquent Property Taxes Tangible Personal Property Installment Payment Plan Ad Valorem Taxes Non-Ad.

A Guide To Your Property Tax Bill Alachua County Tax Collector

9 States Without An Income Tax Income Tax Income Sales Tax

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Real Estate Property Tax Constitutional Tax Collector

Free Notice Of Overdue Rent Form Printable Real Estate Forms Late Rent Notice Letter Template Word Real Estate Forms

Broward County Property Taxes What You May Not Know

Understanding Your Tax Notice Highlands County Tax Collector

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

10 Most Tax Friendly States For Retirees Retirement Advice Retirement Tax

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Parents As Teachers Teacher Organization Parent Teacher Association

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Florida Law Miami Real Estate Real Estate Tips

Awesome Brilliant Corporate Trainer Resume Samples To Get Job Check More At Http Snefci Org Brilliant Corporate Trainer Resume Samples Get Job

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Free Sample Example Format Download Free Premium Templates Letter Templates Free Lettering Cover Letter For Resume